INTRODUCTION

Fintech is a linguistic blend of terms “Finance” and “Technology” and is used to denote technological innovations having an influence over financial services. Scope of Fintech keeps emerging as an when financial institutions and customer embrace technological innovations.

[1]According to Financial Stability Board (FSB), of the BIS, “FinTech is technologically enabled financial innovation that could result in new business models, applications, processes, or products with an associated material effect on financial markets and institutions and the provision of financial services”. This definition aims at encompassing the wide variety of innovations in financial services enabled by technologies, regardless the type, size and regulatory status of the innovative firm. The broadness of the FSB definition is useful when assessing and anticipating the rapid development of the financial system and financial institutions, and the associated risks and opportunities

[2]Technological innovation is considered to be one of the most influential developments affecting the global financial sector in the near future. Innovations related to payments, lending, asset management and insurance pose a challenge to business models and strategies of financial institutions; yet, these also bring opportunities for both the incumbent market participants and newcomers. At the same time, innovation can create new risks for individual financial institutions, consumers of financial services, as well as the financial system as a whole.

[3]Some of the major FinTech products and services currently used in the market place are Peer to Peer (P2P) lending platforms, crowd funding, block chain technology, distributed ledgers technology, Big Data, smart contracts, Robo advisors, E-aggregators, etc. These FinTech products are currently used in international finance, which bring together the lenders and borrowers, seekers and providers of information, with or without a nodal intermediation agency. FinTechs are attracting interest both from users of banking services and investment funds, which see them as the future of the financial sector. Even retail groups and telecom operators are looking for ways to offer financial services via their existing networks. This flurry of activities raises questions over what kind of financial landscape will emerge in the wake of the digital transformation. Financial institutions are seeking to increase their knowledge in relation to technological innovation, both through partnerships with tech companies and by investing in or acquiring such companies. Despite this, there are wide differences in the preparedness of market participants for these changes in practice.

[4]Financial products that traditionally have been the exclusive domain of traditionally licensed credit institutions—payment services and loans, among others—are now offered by fintech firms. These smaller, more agile companies support a greater diversity of products and providers; they promise greater portability of financial products that are now digitized, built on hybrid and cross-industry business models that allow them to access markets often closed to traditional banks and credit offerors. They also offer greater transparency and improved risk management, at least partly enabled by their ability to get instant customer feedback and use it to power real-time adjustments in the services they offer

[5]Fintech Innovations can be categorized into the following

| Payments, Clearing & Settlement | a) Mobile and web-based payments b) Digital currencies c) Distributed ledger |

| Deposits, Lending & capital raising | a) Crowd-funding b) Peer to peer lending c) Digital currencies d) Distributed Ledger |

| Market provisioning | a) Smart contracts b) Cloud computing c) e-Aggregators |

| Investment management | a) Robo advice b) Smart contracts c) e-Trading |

| Data Analytics & Risk Management | a) Big data b) Artificial Intelligence c) Robotics |

FINTECH MARKET

[6]Record number of fintech deals drives total investment to $210 billion in 2021. 2021 has been a remarkable year for the fintech market, with a record number of deals in every major region – including the Americas, EMEA, and the Asia-Pacific. Fintech investment was incredibly strong, with both VC and PE investment soaring to record highs. The breadth of fintech solutions attracting investment continued to expand and grow, with surging interest in cryptocurrencies and blockchain, wealthtech, and cybersecurity.

[7]KPMG, during their study of Fintech Market in 2021 has predicted that –

- Growing number of banks will offer embedded solutions

- There will be increasing regulatory scrutiny of embedded finance offerings

- Fintechs will focus on branding themselves as data organizations

- ESG-focused fintechs will have a big growth trajectory

- There will be a stronger focus on dealmaking in underdeveloped regions

- Unicorn status will lose some of lustre in developed markets, remain key in emerging ones

[8]The Fintech segment in India has seen an exponential rise in funding over the last few years, investments worth more than $8 bn have already been witnessed across various stages of investment in 2021. India has seen tremendous growth on the Digital Payments front, clocking a monthly volume of over 5.7 BN transactions worth ~$2 TN (Total Digital Payments) in September’21. India is home to the highest number of real-time online transactions with 25.5 Bn real time payments transactions in 2020, and is ahead of US, UK and China combined.

[9]FINTECH PRODUCTS

Mobile and web-based payment applications -The majority of developments in the areas of payments are based on mobile technology by providing wrappers over existing payments infrastructure. Examples include Apple Pay, Samsung Pay, and Android Pay, which sit on top of existing card payment infrastructure enabling the user’s mobile devices to act as their credit/debit cards. There are also mobile payments built on new payment infrastructure, for example mobile phone money services, such as M-Pesa in Kenya and IMPS in India, which provide payment services.

Digital currencies (DCs) are digital representations of value, currently issued by private developers and denominated in their own unit of account. They are obtained, stored, accessed, and transacted electronically and neither denominated in any sovereign currency nor issued or backed by any government or central bank. Crypto currencies derive their value solely from the expectation that others will be willing to exchange it for sovereign currency or goods and services. DC schemes may allow for the issuance of a limited or unlimited number of units. In most digital currency schemes, distributed ledger technology allows for remote peer-to-peer exchanges of electronic value.

Distributed ledger technologies (DLT) provide complete and secure transaction records, updated and verified by users, removing the need for a central authority. These technologies allow for direct peer-to-peer transactions, which might offer benefits, in terms of efficiency and security, over existing technological solutions. The impetus behind the development and adoption of distributed ledger technology are the potential benefits. The major benefits are reduced cost; faster settlement time; reduction in counterparty risk; reduced need for third party intermediation; reduced collateral demand and latency; better fraud prevention; greater resiliency; simplification of reporting, data collection, and systemic risk monitoring; increased interconnectedness; and privacy

Block chain is a distributed ledger in which transactions (e.g. involving digital currencies or securities) are stored as blocks (groups of transactions that are performed around the same point in time) on computers that are connected to the network. The ledger grows as the chain of blocks increases in size. Each new block of transactions has to be verified by the network before it can be added to the chain. This means that each computer connected to the network has full information about the transactions in the network. Block chain potentially has far-reaching implications for the financial sector, and this is prompting more and more banks, insurers and other financial institutions to invest in research into potential applications of this technology.

Peer-to-peer (P2P) lenders connect lenders and borrowers, using advanced technologies to speed up loan acceptance. These technologies are designed to increase the efficiency and reduce the time involved in access to credit.

Crowd funding is a way of raising debt or equity from multiple investors via an internetbased platform. Securities and Exchange Board of India (SEBI) has released a paper and defined crowd funding as “solicitation of funds (small amount) from multiple investors through a web-based platform or social networking site for a specific project, business venture or social cause.”

Smart contracts are computer protocols that can self-execute, self-enforce, self-verify, and self-constrain the performance of a contract. Development of smart contracts in relation to financial services could have a large impact on the structure of trade finance or derivatives trading, especially more bespoke contracts, and could also be integrated into Robo-advice wealth management services.

E-Aggregators provide internet-based venues for retail customers to compare the prices and features of a range of financial (and non-financial) products such as standardised insurance, mortgages, and deposit account products. They can also be firms that provide services that allow users to aggregate and analyse their data on their payment patterns, across separate accounts and products (example-Yodlee).

“Robo-advice” is the provision of financial advice by automated, money management providers, thereby disintermediating human financial advisors and reducing costs.

Electronic trading(e-Trading) has become an increasingly important part of the market landscape, notably in fixed income markets. It has enabled a pickup of automated trading in the most liquid market segments. Innovative trading venues and protocols, reinforced by changes in the nature of intermediation, have proliferated, and new market participants have emerged.

[10]Non-Fungible Token – An NFT is a digital asset that represents real-world objects like art, music, in-game items and videos. They are bought and sold online, frequently with cryptocurrency, and they are generally encoded with the same underlying software as many cryptos.

[11]ADVANTAGES AND DISADVANTAGES

| ADVANTAGES | DISADVANTAGES |

| Technological innovations compel banks to modify their way of doing business and earnings models. Banks currently perform activities in several market segments, viz., payments services, raising deposits, lending, and investments, etc. These are segments where technological innovations will result in more high-grade products at lower prices. | If banks do not adopt them quick enough, innovation by rivals may put their business models under pressure. Loss of consumer contact and fragmentation of the value chain could then diminish banks’ ability to profit from the cross-selling market. |

| Global Technology players, viz., Apple, Google and Facebook that adopt innovations effectively and carry technological innovation and new services across the financial value chains. | These companies displace existing financial institutions by exploiting their scale and innovative capacity. |

| FinTech can increase efficiency and diversity by boosting competition within the financial sector. This effect will reduce market concentration and may lead to better services for consumers, in particular as new technological processes often result in greater user-friendliness. | Innovative new entrants provide an incentive for established financial institutions to become more competitive and focus more on their customers. |

| A more diverse financial sector also reduces systemic risk by increasing the heterogeneity between the risk profiles of market participants | FinTech also carries potential risks for the financial sector. These include risks to the profitability of incumbent market players as well as risks related to cyber-attacks |

| the rise of FinTech leads to more and more IT interdependencies between market players (banks, FinTech, and others) and market infrastructures, IT risk events could escalate into a full-blown systemic crisis | |

| The entrance of new FinTech players has not only increased the complexity of the system but has also introduced heightened IT risks for these players who typically have limited expertise and experience in managing IT risks. |

[12]Challenges with Fintech industry

| Organizational |

|

| Cultural |

|

| Regulatory & Governance |

|

| Security & Privacy |

|

| Technology & Standards |

|

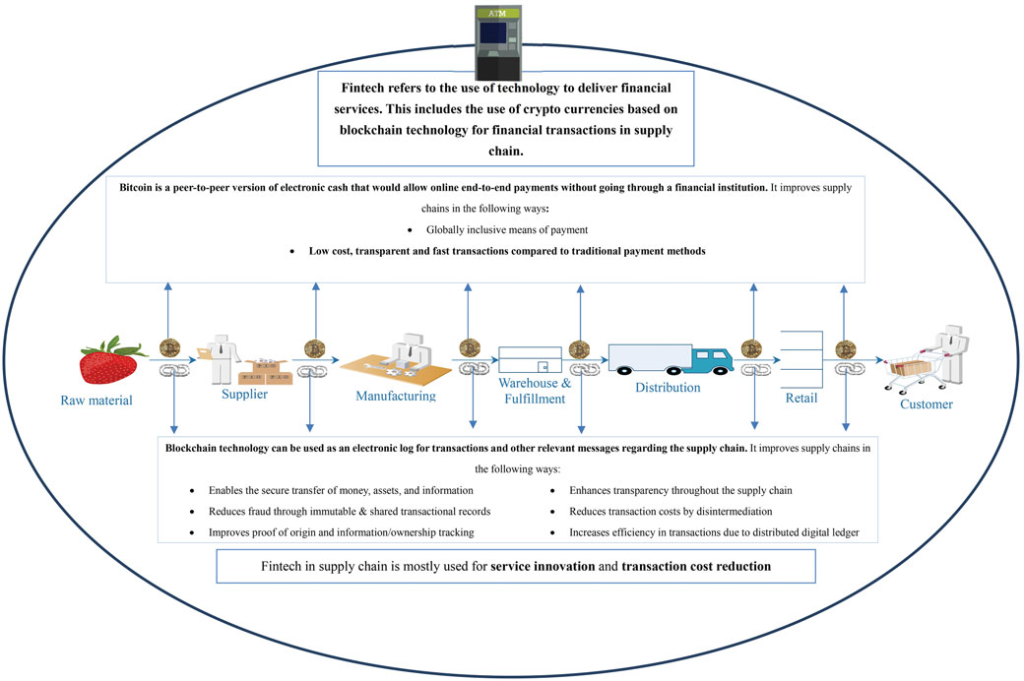

[13]Figure 1- Positioning Bitcoin, Blockchain and Fintech in the supply chain context.

RULES

[14]Section 43A of the Information Technology Act, 2000, provides for payment of compensation by a body corporate in case of negligence in implementing reasonable security practices and procedures in handling sensitive personal data or information resulting in wrongful loss to any person. In terms of section 72A of that Act, disclosure of information, knowingly and intentionally, without the consent of the person concerned and in breach of the lawful contract has been also made punishable with imprisonment for a term extending to three years and fine.

Section 6- Banking Regulations Act,1949- FinTech powered business should ideally be undertaken by only regulated entities, e.g. banks and regulated payment system providers. 3 Section 35A of the Banking Regulation Act empowers the Reserve Bank to issue directions to banking companies in public interest and in the interest of banking polices, etc. Reserve Bank is also empowered under section 36 of the BR Act to caution or prohibit banking companies generally and generally to give advices to banking companies.

The Watal Committee Report recommends that the regulator should enable a formal framework for a regulatory sandbox. A regulatory sandbox can be used to carve out a safe and conducive space to experiment with FinTech solutions, where the consequences of failure can be contained. It also recommended creation of a Payment regulatory board which is yet to be materialized.

[15]The International Financial Services Authority has issued a framework for obtaining authorization as FINTECH Entities

[16]The steering committee on FINTECH related issues has recommended Regulatory framework

CUSTOMER GRIEVANCE

[17]The Reserve bank of India -Integrated Ombudsman scheme will provide cost-free redress of customer complaints involving deficiency in services rendered by entities regulated by RBI, if not resolved to the satisfaction of the customers or not replied within a period of 30 days by the regulated entity.

Legal challenges that will arise for customers using FINTECH will be on Data Protection and Privacy. The Personal Data Protection Bill is yet to be tabled in parliament and rules to be followed by FINTECH players are mentioned in [18]IT Rules,2011 and [19]IT Rules,2021

Relevant Fintech CASE LAWS

| Internet and Mobile Association of India vs. Reserve Bank of India (04.03.2020 – SC) | The Reserve bank issued a statement directing entities regulated by RBI not to deal or provide services to anyone dealing with Virtual Currency and exit such relationships. A writ petition was filed challenging this petition which succeeded and the circular was set aside. |

| Inditrade Fincorp Limited vs. The State of Telangana and Ors. (04.08.2021 – TLHC) | Loan Apps providing loans at hefty amounts and later charging heavy interest and abusing to repay amount or hacking into their phones and causing disrepute to them. The courts ordered freeze of their accounts. |

| Redcarpet Tech Private Limited vs. The State of Telangana and Ors. (05.07.2021 – TLHC) | Harassment using slang language and blackmailing by the FINTECH Company. The freeze on account was removed by bank but allowed Investigation to alleged offences continue |

CONCLUSION

Financial Technology, BlockChains, Digital Currencies, Non Fungible Tokens (NFTs) are driving much interest these days because of the investment potential in these fields. As investors or customers you should be taking advantage of these, it is very important to understands rules, regulations and risk associated to Fintech. There is a lot of potential to be duped as reflective in some case laws. The Indian regulatory perspective on Digital Currency and Non-Fungible token’s is emerging with Regulatory Sandbox by RBI made available to test fintech products. In the recent Chapter III of Finance Bill, 2022, India has given recognition to virtual currencies and NFTs and Budget 2022-23 proposes a 1% tax on payments to virtual currencies beyond INR 10,000 and a flat 30% tax on income from NFTs. As a customer if you are investing in Fintech products other than DCs or NFTs , do ensure these are legitimate ones developed by reputed banks. This will ensure your complaints are treated with utmost importance.

Reference / Footnote

[1] Page 6- https://rbidocs.rbi.org.in/rdocs/PublicationReport/PDFs/WGFR68AA1890D7334D8F8F72CC2399A27F4A.PDF

[2] Page 6- https://rbidocs.rbi.org.in/rdocs/PublicationReport/PDFs/WGFR68AA1890D7334D8F8F72CC2399A27F4A.PDF

[3] Page 10 https://rbidocs.rbi.org.in/rdocs/PublicationReport/PDFs/WGFR68AA1890D7334D8F8F72CC2399A27F4A.PDF

[4] Anne-Laure Mention (2019) The Future of Fintech, Research-Technology Management, 62:4, 59-63, DOI: 10.1080/08956308.2019.1613123

[5] Page 12 https://rbidocs.rbi.org.in/rdocs/PublicationReport/PDFs/WGFR68AA1890D7334D8F8F72CC2399A27F4A.PDF

[6] Page 4 https://assets.kpmg/content/dam/kpmg/xx/pdf/2022/02/pulse-of-fintech-h2-21.pdf

[7] https://home.kpmg/xx/en/home/insights/2022/01/top-fintech-trends-in-h2-2021.html

[8] https://www.investindia.gov.in/sector/bfsi-fintech-financial-services

[9] Page 8-14 https://rbidocs.rbi.org.in/rdocs/PublicationReport/PDFs/WGFR68AA1890D7334D8F8F72CC2399A27F4A.PDF

[10] https://www.forbes.com/advisor/in/investing/what-is-an-nft-how-do-nfts-work/

[11]Page21 https://rbidocs.rbi.org.in/rdocs/PublicationReport/PDFs/WGFR68AA1890D7334D8F8F72CC2399A27F4A.PDF

[12] Samuel Fosso Wamba, Jean Robert Kala Kamdjoug, Ransome Epie Bawack & John G. Keogh (2019): Bitcoin, Blockchain and Fintech: a systematic review and case studies in the supply chain, Production Planning & Control, DOI: 10.1080/09537287.2019.1631460

[13] Samuel Fosso Wamba, Jean Robert Kala Kamdjoug, Ransome Epie Bawack &

John G. Keogh (2019): Bitcoin, Blockchain and Fintech: a systematic review and case studies in the

supply chain, Production Planning & Control, DOI: 10.1080/09537287.2019.1631460

[14] Page57-60 https://rbidocs.rbi.org.in/rdocs/PublicationReport/PDFs/WGFR68AA1890D7334D8F8F72CC2399A27F4A.PDF

[15] F.No. 521/IFSCA/FinTech/FE Framework/2022-23 April 27, 2022

[16] Page 40-50 https://dea.gov.in/sites/default/files/Report%20of%20the%20Steering%20Committee%20on%20Fintech_1.pdf

[17] https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=52549

[18]https://prsindia.org/files/bills_acts/bills_parliament/2011/IT_Rules_2011.pdf

[19] https://prsindia.org/files/bills_acts/bills_parliament/2021/Intermediary_Guidelines_and_Digital_Media_Ethics_Code_Rules-2021.pdf